Range of Pension Scheme Information / Tools / Advice available to ALL Scheme Members

Members have access to a full suite of Pension Scheme information including:

Members have access to a full suite of Pension Scheme information including:

All the above material can be accessed by simply clicking on the relevant section on the left hand side of this page.

- Annual Pension Benefit Statements.

These statements provide members with:

- Confirmation of contributions that have been paid during the period the statement relates.

- Outlines the fund(s), and its value, the member is invested in.

- Provides the member with an estimate of the likely benefits that will emerge in respect of the member at their Normal Retirement Date i.e., their 65th birthday.

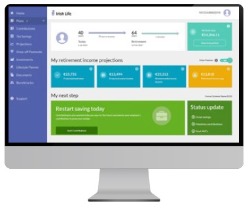

Members no longer have to wait for their annual Pension Benefit Statement to know the value of their pension fund, they can now view same at any time via their Member Portal. The Portal outlines:

- The current value of the member’s fund.

- The projected value of their pension fund at retirement.

- The estimated gross yearly pension income that the member will receive when they retire.

- The target pension that a member should be aiming for. This is calculated as 33% of their current salary, in addition to the State pension.

Further details on the Member Portal and a video on how to register is available here

Irish Life Engagement Team

Irish Life Engagement Team

The Team are available to come and present to members in a group at their place of work – contact your employer for further details on when presentations are scheduled for your organisation.

Members can contact their Irish Life Advice Team point of contact for one-to-one  meetings regarding their pension fund. The Advice Team member assigned to each employer and their relevant contact details is available here. It is never too early to start engaging about your pension fund and discuss what benefits you could possibly expect based on your current pension contributions. You could also discuss Additional Voluntary Contributions (AVCs) and what difference it would make to your pension fund if you commenced same. You can also seek independent financial advice if you wish.

meetings regarding their pension fund. The Advice Team member assigned to each employer and their relevant contact details is available here. It is never too early to start engaging about your pension fund and discuss what benefits you could possibly expect based on your current pension contributions. You could also discuss Additional Voluntary Contributions (AVCs) and what difference it would make to your pension fund if you commenced same. You can also seek independent financial advice if you wish.

Members with less than 15 years to their Normal Retirement Age

In addition to all the above information / tools / advice available to all Scheme members, members with 15 years to retirement will be:

- Invited to attend a series of Online Webinars

Invitations will issue via employers and information will also be available on the Online Group Presentations section of this website.

- Nudge Communication

Members will get “nudge” communication via emails or when using the Member Portal to not forget to engage with their Advice Team point of contact; reminders of webinars being organised for them on different themes appropriate to them etc.

Members with less than 5 years to their Normal Retirement Age

Again, in addition to all the above information / tools, members with 5 years to retirement will be:

- Invited to attend a Retirement Seminar

The Seminar is a one-day event and is free of charge for members of the Scheme. Employers are responsible for inviting members to attend from their organisation who are within 5 years from their Normal Retirement Age (NRA) i.e., age between 60-65years. People who are seeking to retire earlier are also invited to attend. An invitation to attend the Seminar is also extended to the member’s spouse / partner / friend. Tea / coffee breaks and lunch is provided to delegates attending on the day. The following topics are addressed in detail and in a practical common-sense way to help members better plan for their retirement:

The Mental Adjustments of Retirement

The Mental Adjustments of Retirement- Pension Scheme Benefits

- State Benefits in Retirement

- Wills and Inheritance

- Physical & Nutritional Wellbeing in Retirement

If you are interested in attending a Retirement Seminar, please register your interest with your employer. Also details of dates and venues for the Retirement Seminars will be uploaded on this webside under heading Retirement Planning Seminars section.

- Issued with a personalised letter

Members are issued with a personalised letter from their Irish Life Advice Team point of contact inviting them to engage with them so members have:

Irish Life Advice Team point of contact inviting them to engage with them so members have:

- a clear understanding and expectation of what their pension fund will be at retirement.

- Understand what way they will draw down their pension fund at retirement.

- Approaching Retirement Section of www.fedvol.ie

On this Federation’s website a dedicated “Approaching Retirement” Section has been included. This section provides members with a wealth of information for members approaching retirement including:

Advice

Advice

The draw down of a member’s pension fund is not an automatic process, members need to engage with Irish Life and the sooner the engagement commences, the smoother their retirement journey will be. Members are strongly encouraged to engage with their Advice Team point of contact on an annual basis during their last 5 years to retirement to ensure they are invested in the right investment funds to match the way they will draw down their pension fund at retirement – Don’t leave it to your final year!

Irish Life are aware that pensions to many people is complex, that is why the Pension Scheme Trustees strongly encourage members to engage with Irish Life early, so Irish Life can assist members in this important stage of their pension journey to retirement.