Your Pension Fund is a Long-Term Investment

The world of investment markets can seem like a rollercoaster. The ups and downs, the jargon... it’s not exactly easy to follow, and when you hear that your pension fund is affected, it can feel a bit worrying. After all, most of us don’t naturally think of our pension fund as an "investment"!

Your pension fund is a long-term investment and that’s actually a good thing. It’s built to handle the bumps along the way – those market ups and downs – so you don’t have to stress over every twist in the road. The key? Stick with it. Keep saving steadily and consistently. That’s how you stay on track to reach your retirement goals.

To help make things a bit clearer, Irish Life and the Trustees have put together some handy supports / points outlined below for anyone who wants to learn more, including a short video that discusses the nature of long-term investing.

Check out the information below and take a few minutes to feel a little more confident about your pension.

1. Market Update and Volatility Considerations

Irish Life has extensive, and years, of experience in providing pensions across Ireland for many members. They have provided pensions over the long-term, through many different financial market conditions.

Want to keep up with what’s happening in the markets? You can click here to view and download our regularly updated market insights, along with considerations for long term investment which are particularly relevant when financial markets are volatile.

Curious about how your own pension fund is performing? You can check out the most recent investment performance information through Irish Life's fund fact sheets – just click here, or log in anytime through your online member portal.

2. Dedicated Webinar

Watch the ‘Investments: the engine behind your pension’ webinar, designed to give you insight into how your pension works from an investment perspective.

If you've ever wondered how the investment side of your pension works, or been worried about how the ups and downs of the investment markets might impact your pension fund, this webinar is well worth a watch.

In this webinar you'll:

• Gain valuable insights into long-term investing

• Understand how pension funds work to beat inflation

• Discover the importance of your online pension portal

3. Frequently Asked Questions (FAQs)

Below, you'll find answers to some commonly asked questions from our members about market ups and downs and their pension fund:

- What to do during times of Volatility

We know that, when it comes to investing, uncertainty is uncomfortable for most people. Equity market highs and lows can often prompt short-term, emotional decision-making and the desire to buy or sell when perhaps the right thing to do is nothing. It can be tempting to switch some or all of your retirement savings to lower-risk funds or even cash. While switching is available to you as a free option, it is worth remembering that even professional investors find it difficult, if not impossible, to consistently time when markets will rise or fall. More often, people are driven by sentiment and may exit funds when they have already fallen, only to buy them back later at a higher price when equity markets have recovered. This simply erodes the value of your pension savings over time. Getting invested, and staying invested, has been shown to be the most effective strategy over time.

- How can I view my pension fund value?

If you want to check your pension fund value etc, register or log in to your online Pension Portal. When logged in, you can also check the latest fund price and performance information. Log in to your online Pension Portal where you can access all of your pension scheme information, view transactions, update contact details and download documents. If you haven’t signed up already, you can sign up here.

- I'm invested in the Scheme's Default Investment Strategy - Personal Lifestyle Strategy (PLS) - how can I learn more about this?

Saving into the Penson Scheme's Default Investment Strategy - Personal Lifestyle Strategy (PLS) has two main benefits over the years of saving for retirement: (1) Managing investment risk and (2) personalised fund switches. PLS includes a whole range of options to manage market volatility. Irish Life have created a summary document, which outlines the fund options and characteristics within a Personal Lifestyle Strategy to help you better understand your long-term investment. Members can also review the Pension Scheme's Investment Guide.

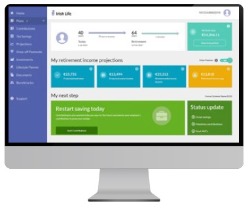

4. Your Online Pension Portal

Your online Pension Portal gives you 24/7 access to review your pension fund at any time that suits you.

- The "Dashboard" lets you see the status of your pension fund at a glance.

- The "Projections" tool shows you how small increases today could make a big difference to your projected retirement income in the long run.

- The "My Next Step" tool shows you the next best step you can take today to take control of your financial future.

If you haven’t registered yet to get online access to your pension fund, click here for further information about the online Pension Portal. Also we have made available two videos for members to watch re:

5. Irish Life Advice Team

If you wish to discuss your pension fund, please engage directly with your Irish Life Advice Team point of contact assigned to your organisation.

Members can contact their Irish Life Advice Team point of contact for one-to-one meetings regarding their pension fund. It is never too early to start engaging about your pension fund and discuss what benefits you could possibly expect based on your current pension contributions. You could also discuss Additional Voluntary Contributions (AVCs) and what difference it would make to your pension fund if you commenced same. You can also seek independent financial advice if you wish.

Members can contact their Irish Life Advice Team point of contact for one-to-one meetings regarding their pension fund. It is never too early to start engaging about your pension fund and discuss what benefits you could possibly expect based on your current pension contributions. You could also discuss Additional Voluntary Contributions (AVCs) and what difference it would make to your pension fund if you commenced same. You can also seek independent financial advice if you wish.

It is highly recommended that, especially during the final 6 years prior to your retirement date, you engage with your Irish Life Advice Team contact to understand the different ways you can draw down your pension fund on retirement. This is a big decision and should be discussed well in advance of your retirement date.

You can contact Irish Life by:

- Emailing fedvol@irishlife.ie or

- Telephone 01-8563753 between 10am - 1pm and 2pm - 4pm any working day.

When corresponding with Irish Life please ensure you include your Scheme Number and Member Number in your email / all correspondence you send to Irish Life so they can quickly assist you. You can find your Scheme Number and Member Number:

- on the correspondence you recevied from Irish Life welcoming you to the Scheme.

- when you log on to your Online Member Portal.

- on your Pension Benefit Statement which you receive annually from Irish Life.

All queries in relation to your pension fund should be directed to Irish Life who can give you financial advice.

If you have any further queries on any aspect of our Pension & Life Assurance Scheme, please contact Maria McMahon, Pension Scheme Manager, National Federation of Voluntary Service Providers’ Pension & Life Assurance Scheme, Oranmore Business Park, Galway.