NEWSLETTERS:

National Federation Pension and Life Assurance Newsletter October 2025

National Federation Pension and Life Assurance Newsletter March 2025

National Federation Pension and Life Assurance Newsletter October 2024

National Federation Pension and Life Assurance Newsletter March 2024

National Federation Pension and Life Assurance Newsletter October 2023

National Federation Pension and Life Assurance Newsletter Oct 2022

Investment Markets and Fund Update Oct 2022 (referenced in Oct Newsletter)

National Federation's Pension and Life Assurance Newsletter April 2022

National Federation’s Pension and Life Assurance Newsletter November 2021

National Federation’s Pension & Life Assurance Newsletter March 2021

National Federation’s Pension & Life Assurance Scheme Newsletter June 2020

TOP UP YOUR PENSION FUND BY MAKING A LUMP SUM ADDITIONAL VOLUNTARY CONTRIBUTION (AVC) AND CLAIM BACK TAX FOR 2024 BEFORE REVENUE DEADLINE OF 31st OCTOBER, 2025

Irish Life are helping Pension Scheme Members to make lump sum AVC payments into their pension fund and claim back tax for 2024 before the Revenue deadline of 31st October, 2025 (or the later date of 19th November, 2025, if you file your tax returns through ROS).

into their pension fund and claim back tax for 2024 before the Revenue deadline of 31st October, 2025 (or the later date of 19th November, 2025, if you file your tax returns through ROS).

Irish Life have compiled a comprehensive suite of resources to give members the know-how and support to make the process as easy as possible:

Members should contact their Irish Life Advice Team point of contact if they wish to discuss if this is the right decision for them.

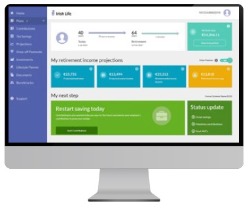

IRISH LIFE MEMBER PORTAL:

Irish Life's ‘Member Portal’, which is an online account for your pension fund, is now live so you can view your own pension fund and use the many great online tools Irish Life have made available to you, to help you plan for your retirement.

The Member Portal allows you to:

- Review your personal contact information, including adding your mobile

number and updating your personal email address onto your record.

number and updating your personal email address onto your record.

- Check your current pension fund value which includes the transfer amount from New Ireland, if you previously contributed to the Scheme.

- Review your investment choice.

- Check out the projections tool which is a great help for targeting the income level you want to have at retirement.

- Carry out an investment fund switch.

- Update your beneficiary details in the event of your death.

- View your Document Library which contains all letters and correspondence sent to you from Irish Life.

To access your pension information online and at any time that suits you, you need to register for the online Member Portal. If you have already given Irish Life your email address or mobile phone number, you can register now and get access to your online pension account.

If you have not already provided your personal details to Irish Life, the above Member Portal link will not work for you. To get access, please email fedvol@irishlife.ie with the following details and they will be happy to help you get set up:

- Your name and address

- Employer name

- Date of Birth

- Mobile number

- Personal email address

If you follow the steps in the Member Portal Video, you should be able to register for the Member Portal with no problems.

Once you have registered for the Member Portal, as outlined above, you can then download the “Irish Life EMPOWER” app on your mobile phone. iPhone users can go to the Apple Store to download the app. Android users can download the app from the Google Play Store.

TRANSFER IN / TRANSFER OUT OPTIONS:

If you are joining the National Federation of Voluntary Service Providers Pension & Life Assurance Scheme (NFVSP Scheme) and are considering whether to “Transfer In” a previous pension fund, please read this document for some useful information. Similarly, this document will also provide information to members who are leaving the NFVSP Scheme and wondering can they “Transfer Out”  their fund to another Pension Scheme / Product. The document outlines what retirement products are allowed to “Transfer In” to the NFVSP Scheme and what retirement products are allowed receive a “Transfer Out” from NFVSP Scheme under current Revenue rules (August 2024). It is important members obtain independent financial advice prior to deciding to Transfer In / Transfer Out their pension fund, to ensure they are making the right decision.

their fund to another Pension Scheme / Product. The document outlines what retirement products are allowed to “Transfer In” to the NFVSP Scheme and what retirement products are allowed receive a “Transfer Out” from NFVSP Scheme under current Revenue rules (August 2024). It is important members obtain independent financial advice prior to deciding to Transfer In / Transfer Out their pension fund, to ensure they are making the right decision.