Please view the following suite of videos in relation to the National Federation of Voluntary Service Providers Pension & Life Assurance Scheme:

Please view the following suite of videos in relation to the National Federation of Voluntary Service Providers Pension & Life Assurance Scheme:

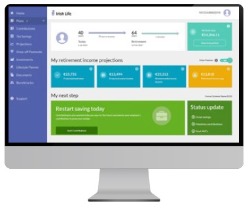

Watch the Member Portal Registration Video which will outline the steps involved to get access to your pension fund online.

The Member Portal allows you to:

The Member Portal allows you to:

-

Review your personal contact information, including adding your mobile number and updating your personal email address onto your record.

-

Check your current pension fund value which includes the transfer amount from New Ireland, if you previously contributed to the Scheme.

-

Review your investment choice.

-

Check out the projections tool which is a great help for targeting the income level you want to have at retirement.

-

Carry out an investment fund switch.

-

Update your beneficiary details in the event of your death.

-

View your Document Library which contains all letters and correspondence sent to you from Irish Life.

Members should watch the Member Portal Information Video which:

- Outlines the main features of the Member Portal as outlined above.

- Demonstrates how to use the pension projections tools included in the Member Portal.

When you first join the Pension Scheme, your pension contributions will be invested in the Scheme's default investment strategy i.e., EMPOWER Personal Lifestyle Strategy (PLS).

Once your personal member record is set up in the Scheme, you will receive a ‘Welcome Pack’ from Irish Life. You can then switch to any of the other investment funds available to Scheme Members using the Irish Life Member Portal, or by downloading an investment fund switch form.

For information on the Default Investment Fund, EMPOWER Personal Lifestyle Strategy (PLS) and how it works view this PLS Video.

This video provides Pension Scheme Members with an outline of the following:

-

Overview of your Scheme, including pension contribution guidance;

-

Investment choices available to you; and

-

An introduction to some of the great online tools Irish Life can provide to help you plan for your retirement.

This video explains:

-

What is an AVC.

-

How a member can commence making AVCs.

-

How much a member can contribute to their Pension Fund as a AVC.

-

Contact details to the Irish Life Advice Team if a member wishes to speak to someone to ensure that commencing AVCs is the right decision for them.

In this video Irish Life explain:

In this video Irish Life explain:

- the fees that you pay on your pension fund; and

- how and when they are deducted from your fund.

These fees are known as Annual Management Charges (AMCs) and they pay for all the services that Irish Life provide to you within the Scheme from administration to investments, online services & member engagement.

The Annual Management Charge you pay is calculated as a percentage of the value of your pension fund. This charge is then deducted from the growth that your pension fund achieves and the net return is then added to your pension fund. These calculations are done on a daily basis. Since the Annual Management Charge (AMC) is applied as part of the daily fund prices i.e., is a built-in daily charge to the unit price of each of the Scheme’s investment funds, it is for this reason, Irish life are not in a position to itemise the fee on an annual basis and include the figure on your Pension Benefit Statement (PBS), hence the heading ‘money deducted from your pension’ on your Pension Benefit Statement equates to zero and Irish Life just outline the AMC% of each investment fund.

This flyer outlines the steps involved for a member who wants to transfer a pension value into a new or existing Irish Life pension fund i.e., National Federation's Pension & Life Assurance Scheme.

If you are joining the National Federation of Voluntary Service Providers Pension & Life Assurance Scheme (NFVSP Scheme) and are considering whether to "Transfer In" a previous pension fund, please also read this document for some useful information. Similarly, this document will also provide information to members who are leaving the NFVSP Scheme and wondering can they "Transfer Out" their fund to another Pension Scheme / Product. The document outlines what retirement products are allowed to "Transfer In" to the NFVSP Scheme and what retirement products are allowed receive a "Transfer Out" from the NFVSP Scheme under current Revenue Rules (August 2024). However, it is important members obtain independent financial advice prior to deciding to Transfer In / Transfer Out their pension fund, to ensure they are making the right decision.

If you are joining the National Federation of Voluntary Service Providers Pension & Life Assurance Scheme (NFVSP Scheme) and are considering whether to "Transfer In" a previous pension fund, please also read this document for some useful information. Similarly, this document will also provide information to members who are leaving the NFVSP Scheme and wondering can they "Transfer Out" their fund to another Pension Scheme / Product. The document outlines what retirement products are allowed to "Transfer In" to the NFVSP Scheme and what retirement products are allowed receive a "Transfer Out" from the NFVSP Scheme under current Revenue Rules (August 2024). However, it is important members obtain independent financial advice prior to deciding to Transfer In / Transfer Out their pension fund, to ensure they are making the right decision.

This video outlines what happens my pension fund if I leave the NFVSP Scheme.

This video covers:

-

What you can do between now and retirement to possibly increase your pension fund.

-

What way you can draw down your pension fund at retirement to best meet your personal circumstances and requirements.

-

An outline of what are the steps involved to access your pension fund at retirement.

Irish Life hosted 2 online webinars entitled “Countdown to Retirement” on 6th December, 2023. This Countdown to Retirement webinar was aimed at any age group, but was especially beneficial to members over age 50. The webinar addressed the topics members need to consider as part of their countdown to retirement, including:

How tax relief works.

How tax relief works.- Additional Voluntary Contributions (AVCs).

- The Scheme’s Default Personal Lifestyle Strategy and the Scheme’s other investment fund options.

- How to register and utilise the tools within your online Member Portal.

- Signpost to other great supports available to Scheme members e.g. engagement with Advice Team and National Federation’s website.

A recording of the Countdown to Retirement Webinar is now available to view here.

This video outlines what transfer and retirement options are available for Deferred Members of the National Federation of Voluntary Service Providers Pension & Life Assurance Scheme. A deferred member is someone who has left employment from a Participating Employer of our Pension Scheme, but has retained benefits in the Pension Scheme.

Since we are often saving into a pension over a long period of time, please watch this long term investing video that discusses the nature of long-term investing.

Irish Life want to build better futures by investing pension scheme members’ money better. That means aiming to grow members’ money, but doing it in a way that does more to help our planet and the people on it, with the objective of delivering longer-term sustainable returns. Through Irish Life Investment Managers (ILIM), Irish Life do this by:

-

Reducing exposure to carbon intensive companies.

-

Using Irish Life’s position as stakeholders to influence companies to act better.

-

Being committed to a lower carbon future.

-

Being one of the first Irish companies to sign up to the United Nations Principles for Responsible Investing (UNPRI).

Watch Irish Life’s video on what is Responsible Investing to find out more information on this topic.